The landscape of mergers and acquisitions is changing fast, making secure data management more critical than ever for business owners and deal professionals. Choosing the right data room providers can mean the difference between a smooth, confidential transaction and costly delays. This article guides you to the best data room providers for lower-middle market deals, highlighting seven top options with unique features, transparent pricing, and buyer-seller focus. Discover how proprietary platforms like Aligned IQ empower sellers with low-risk, confidential exits and offer high-quality value-added tools such as a secure Virtual Data room for M&A. Explore each provider’s strengths and take a tour to find your ideal fit.

What to Look for in a Data Room Provider

Selecting the right data room providers is crucial for lower-middle market M&A deals. The right solution protects your sensitive information, streamlines collaboration, and ensures your transaction runs smoothly from the start. Below, we break down the key factors to evaluate before making your choice.

Security and Compliance Standards

Security forms the backbone of all reputable data room providers. Look for platforms with bank-grade encryption, two-factor authentication, and end-to-end data encryption (Aligned IQ VDR Security). These standards help shield financial statements and personal data during due diligence, a critical phase for confidential lower-middle market transactions.

Leading providers differentiate themselves with dynamic watermarks, detailed audit logs, and role-based access controls. For example, a sell-side advisor in healthcare must ensure HIPAA compliance and granular tracking of document access. Choosing a provider with these robust features minimizes risk and builds trust among all deal participants.

Usability and Collaboration Tools

Ease of use is essential, especially for teams without deep IT resources. Top data room providers offer intuitive interfaces, quick onboarding, and features like drag-and-drop uploads, bulk document management, and full-text search. This allows even small teams to organize and retrieve critical files efficiently.

Collaboration tools matter, too. Real-time Q&A modules, comment threads, and granular permissions foster secure communication. Integration with productivity tools such as Slack, Office 365, and Google Drive, plus reliable mobile access, streamline workflows. Modern VDRs address user pain points by reducing complexity and ensuring everyone can participate confidently in the process.

Pricing Transparency and Scalability

Transparent pricing is vital for lower-middle market sellers who need to manage costs. Data room providers typically offer flat-rate, per-page, per-user, or pay-as-you-go models. Unlimited users, scalable storage, and flexible contracts support companies as they grow or manage multiple deals.

Look for free trial periods and clear refund policies to reduce risk. Comparing Virtual Data Room Providers Comparison 2025 can help you evaluate features and pricing side by side. Transparent pricing not only simplifies budgeting but also fosters trust and speeds up the decision-making process. Take a Tour to see which provider best fits your needs.

Top 7 Data Room Providers to Consider in 2025

Choosing among the best data room providers is crucial for business owners, buyers, and advisors aiming to streamline M&A transactions. The right provider can mean the difference between a smooth deal process and costly delays. Each of the following data room providers offers distinct strengths tailored for the lower-middle market. Explore their features, pricing, and suitability to find the best fit for your next transaction. For a broader perspective, see the Best Virtual Data Room Providers in 2025 for more insights.

Aligned IQ

Aligned IQ stands out among data room providers with its proprietary matchmaking platform, designed specifically for lower-middle market business owners and buyers. What sets Aligned IQ apart is its built-in, free virtual data room for sellers after a match is made, ensuring confidentiality and zero upfront risk. Buyers and other M&A professionals can subscribe to the Aligned IQ VDR with transparent monthly or annual subscriptions and can cancel anytime. Investment Banks or others needing multi-tenant colutions can subscribe to the Aligned iQ VDR Enterprise platform.

The platform empowers sellers by offering secure document sharing, role-based access controls, and robust compliance measures. Aligned IQ is optimized for those who prioritize strategic fit and relationship-building before entering deep due diligence. The vetted network of M&A advisors and service providers further streamlines the process, reducing traditional costs and friction. This approach is especially effective for business owners seeking a confidential, low-risk exit and buyers looking for pre-qualified opportunities.

Pros:

- Seller empowerment

- Zero upfront fees for Buyers (pay for results only – i.e. closed deals facilitated on the platform) and subscription-based VDR priced as low as $49.95/mo with free 7-day trial

- Industry-specific matchmaking

- Free match-making platform and VDR for sellers

Cons:

- Best for deals under $100M enterprise value

- Not designed for large-cap transactions

Ideal for:

Business owners seeking confidential, low-risk exits and buyers seeking pre-qualified opportunities.

Take a Tour

Fordata

Fordata is a leading European name among data room providers, offering advanced AI-driven redaction and multilingual translation tools. This makes Fordata especially well-suited for cross-border M&A, finance, healthcare, and real estate deals in the lower-middle market.

With 24/7 support, GDPR compliance, and robust 256-bit encryption, Fordata ensures your sensitive data is always protected. Real-time document activity reporting helps both sellers and buyers track investor engagement. Pricing starts at €199 per month for the VDR Lite plan, scaling up as your needs grow. While multilingual support and security are strengths, some advanced features are reserved for higher-tier plans, which may impact smaller teams.

Pros:

- Multilingual and cross-border capabilities

- Strong security and compliance

- Transparent, scalable pricing

Cons:

- Advanced features only in higher tiers

- May cost more for very small teams

Best for:

Cross-border deals and industries requiring robust compliance.

Take a Tour

FirmRoom

FirmRoom is a user-friendly option among data room providers, popular for its transparent, flat-rate pricing and unlimited user access. At $495 per month (billed annually), FirmRoom is cost-effective for growing teams in mid-market M&A, investment banking, and private equity.

FirmRoom is SOC 2 certified and offers drag-and-drop uploads, full-text search, and granular permissions. Real-time collaboration features, such as built-in Q&A modules, make due diligence efficient. While the base plan includes 10GB of storage, additional storage can be purchased as needed. A 14-day free trial lets teams evaluate the platform risk-free.

Pros:

- Simple setup

- Unlimited users

- 24/7 customer support

Cons:

- Base storage is limited

- Extra charges for additional storage

Ideal for:

Mid-market M&A professionals and teams prioritizing usability and cost control.

Take a Tour

Intralinks

Intralinks is one of the most established data room providers for enterprise and global transactions. Its platform offers AI-powered document redaction, advanced analytics, and dynamic indexing, all protected by ISO 27701 certification.

With advanced Q&A, audit trails, and mobile access, Intralinks supports complex, high-stakes deals. Pricing is available on request and is typically best for larger, more complex transactions. The platform’s automation and compliance features are top-tier, though its learning curve and cost may be challenging for small teams.

Pros:

- Enterprise-grade automation

- Strong compliance and analytics

- Dedicated support

Cons:

- Higher cost

- May be complex for small teams

Best for:

Large, intricate M&A transactions, fundraising, and capital markets.

Take a Tour

ShareFile

ShareFile is a standout among data room providers for small businesses seeking secure, affordable document sharing. Its platform integrates seamlessly with Google Drive and Dropbox, making it easy to adopt for teams with existing tools.

With transparent, tiered pricing and features like granular permissions, e-signatures, and audit trails, ShareFile is built for simplicity and security. While it may lack some advanced M&A-specific features, its cost-effectiveness and easy onboarding make it ideal for straightforward document management.

Pros:

- Easy integration with popular tools

- Affordable for small businesses

- Secure sharing and e-signatures

Cons:

- Limited advanced features for M&A

Best for:

Small businesses needing a secure, simple data room solution.

Take a Tour

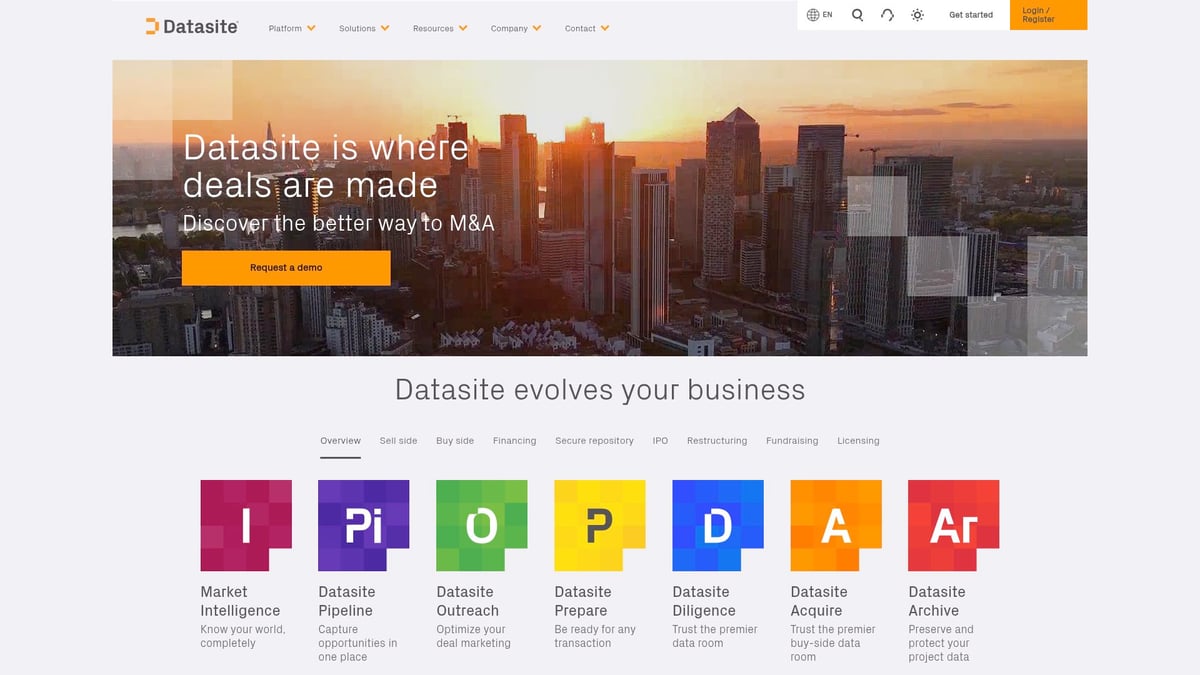

Datasite

Datasite specializes in seller-side M&A and is a top choice among data room providers for advisors and investment banks. The platform offers AI-driven redaction, workflow automation, and advanced analytics, all supported by enterprise-level security.

Datasite is scalable, serving both small and large deals, with pricing available on request. Its robust reporting and project management tools help teams handle multiple deals efficiently. However, its enterprise pricing structure may be prohibitive for some smaller businesses.

Pros:

- Advanced automation and analytics

- Strong M&A focus

- Scalable for various deal sizes

Cons:

- Higher cost for small businesses

Ideal for:

Advisors, investment banks, and corporate development teams.

Take a Tour

Securedocs

Securedocs is a straightforward and reliable choice among data room providers, especially for small businesses and advisors. Its transparent, flat-rate pricing makes budgeting easy, while unlimited users and documents allow for scalability as deal volume grows.

Core features include permission controls, detailed audit logs, and a quick setup process. Securedocs is ideal for those seeking predictable costs and easy onboarding, though it lacks some of the advanced analytics and AI features found in other platforms.

Pros:

- Predictable flat-rate pricing

- Unlimited users and documents

- Quick, simple onboarding

Cons:

- Fewer advanced features

Best for:

Small businesses and advisors focused on reliable, secure document sharing.

Take a Tour

How Data Room Providers Are Evolving for Lower-Middle Market M&A

The landscape for data room providers is shifting rapidly, especially to meet the specific needs of lower-middle market M&A. These changes are making secure deal management more accessible, efficient, and tailored for business owners and advisors who value confidentiality and simplicity.

AI and Automation in Due Diligence

AI-powered features are now central in data room providers, with tools like document redaction, auto-indexing, and instant translation. These innovations, as seen in Fordata’s AI-driven redaction for cross-border deals, help smaller teams accelerate due diligence and reduce manual errors. For a deeper dive into how AI is transforming M&A workflows, explore AI in M&A transactions. These advancements mean lower-middle market firms can get deal-ready faster without building large internal teams.

Integration with M&A Platforms and Deal Networks

A significant trend is the integration of data room providers with proprietary M&A platforms. Aligned IQ, for example, offers a seamless transition from confidential matchmaking to secure diligence, giving sellers free VDR access post-match. This end-to-end approach reduces friction and costs, making exits more confidential and low risk compared to traditional processes.

Enhanced User Experience and Accessibility

User experience is a top priority for data room providers serving the lower-middle market. Intuitive dashboards, mobile access, and unlimited user models are replacing the old, complex enterprise tools. Platforms like FirmRoom and Securedocs ensure that even companies with limited IT resources can set up a secure, collaborative workspace quickly, making deal management less daunting.

Transparent Pricing and Flexible Contracts

Transparent, flat-rate pricing is now the standard among leading data room providers. Solutions like Securedocs and FirmRoom offer clear costs, unlimited users, and flexible contracts, supporting trust and predictable budgeting. This clarity is especially valuable for lower-middle market sellers who need to manage deal expenses closely and avoid hidden fees.

Key Considerations When Choosing Your Data Room Provider

Selecting the right data room providers can make or break your transaction, especially for lower-middle market business owners and buyers. The right solution will safeguard sensitive documents, speed up due diligence, and help you achieve a smoother, more confidential deal experience.

Key Factors to Evaluate:

- Document Sensitivity: Consider how your deal’s complexity and confidential materials require secure handling. For practical tips on preparing for diligence, review Pre-sale due diligence best practices.

- Feature Fit: Match provider features to your team’s tech skills and expected deal volume. Tools like drag-and-drop uploads, Q&A modules, and mobile access can streamline workflows.

- Compliance and Security: Ensure robust encryption, permissions, and audit trails, especially if you operate in regulated sectors like healthcare or finance.

- Support and Onboarding: Responsive support and guided onboarding are essential if your team has limited IT resources.

- Pricing Transparency: Compare trial periods, contract flexibility, and total cost. Transparent pricing helps avoid surprises and builds trust throughout the transaction.

Industry-Specific Matchmaking vs. Generic Storage

Aligned IQ stands out for its proprietary, confidential matchmaking platform offering free VDR access for sellers after a match. This approach reduces upfront risk and empowers business owners to focus on strategic fit rather than just document storage.

Real-World Scenario

Choosing the right data room providers can accelerate deal speed, maintain confidentiality, and directly influence your transaction’s outcome. Take a Tour of top platforms to discover which solution aligns best with your needs and team.

As you’ve seen, choosing the right data room provider can make all the difference in keeping your deal secure, efficient, and on track—especially in the fast-moving world of M&A. Whether you’re a business owner preparing for an exit, a buyer searching for the perfect fit, or an advisor managing multiple deals, it pays to see these platforms in action. I encourage you to explore how today’s top VDR solutions can streamline your next transaction and help you feel confident every step of the way. Ready to find the best match for your needs? Schedule a Demo today!

No responses yet