Are you considering selling your business in 2026? The stakes are high, and with the right strategy, you can turn this moment into a rewarding milestone rather than a missed opportunity.

To truly prepare my business to sell, it takes more than a quick decision. Careful planning, clear documentation, and the right advisors can boost your business’s value and make the process smooth.

In this guide, you will discover actionable steps to assess your business, organize your records, enhance value, select advisors, attract qualified buyers, and navigate due diligence. Follow each step to maximize your sale price and secure the best future for your company.

Step 1: Assessing Readiness and Setting Goals

Preparing to sell a business is more than a financial transaction. To successfully prepare my business to sell, it is vital to begin with clear goals, an honest assessment of readiness, and a plan that aligns your aspirations with market realities. This foundational step sets the stage for a smooth and profitable exit.

Clarifying Personal and Financial Objectives

Start by defining your reasons for selling. Are you considering retirement, pursuing new ventures, or seeking to achieve specific financial milestones? Establishing a clear target timeline, ideally 1 to 2 years, gives you time to prepare my business to sell at maximum value.

Outline your desired sale price and what you want your life to look like post-sale. Think about emotional readiness—how will the change impact you, your family, and your employees? For example, a manufacturing business owner planning a 24-month exit can set specific milestones for value growth and team transitions.

- Reasons to sell: retirement, new opportunities, financial goals

- Timeline: 12 to 24 months for optimal preparation

- Sale price: set realistic expectations

- Emotional impact: consider employees and legacy

For additional actionable tips, see Steps to Make Your Business Exit Ready.

Evaluating Business Performance and Market Position

Review your business’s historical financials, focusing on revenue trends and profitability. Benchmark performance against industry peers to understand your competitive position. Analyze customer concentration—buyers pay more for businesses with a diversified client base and consistent growth.

Assess recurring revenue streams and future growth potential. Identify operational strengths and weaknesses, such as supply chain reliability or proprietary processes. Buyers in the lower-middle market often pay higher multiples for businesses showing stable earnings and low dependency on a single customer.

- Financial review: 3-5 years of statements

- Benchmarking: compare with industry data

- Customer base: assess concentration risk

- Growth potential: highlight opportunities

This holistic assessment is crucial as you prepare my business to sell.

Identifying Potential Deal Structures

Explore which deal structure best fits your goals and the current market. The two most common are asset sales and stock sales, each with tax and liability implications. Some owners opt for partial sales, earn-outs, or phased transitions to maximize proceeds and reduce risk as they prepare my business to sell.

- Asset sale: buyer acquires selected assets, less risk for buyer

- Stock sale: buyer takes over entire company, more complex but may benefit seller

- Partial sale or earn-out: seller stays involved during transition

- Align structure with personal and financial objectives

Evaluate which option aligns best with your expectations, market norms, and the needs of prospective buyers.

Step 2: Organizing Financials and Key Documentation

Getting your records in order is one of the most critical steps when you prepare my business to sell. Buyers expect clarity, transparency, and quick access to information. A well-organized package not only builds trust but can also speed up negotiations and maximize your sale price.

Preparing Accurate and Transparent Financial Statements

To prepare my business to sell, start by putting together three to five years of income statements, balance sheets, and cash flow statements. These should be professionally prepared, ideally audited or at least reviewed by a CPA. Clear, accurate numbers give buyers confidence in your business.

Recasting your financials is also essential. This means adjusting your statements to show normalized owner compensation and excluding non-recurring expenses. Highlight adjusted EBITDA and other key earnings metrics. For example, lower-middle market buyers often look for clear add-backs, such as one-time legal fees or personal expenses, to accurately assess value.

A summary table can help:

| Statement Type | Years Required | Notes |

|---|---|---|

| Income Statement | 3-5 | Show trends, highlight add-backs |

| Balance Sheet | 3-5 | Clean up debts, clarify assets |

| Cash Flow | 3-5 | Demonstrate liquidity |

Compiling Legal, Operational, and Compliance Documents

When you prepare my business to sell, gather all corporate documents such as articles of incorporation, bylaws, and shareholder agreements. Buyers will want to review contracts, including leases, supplier agreements, customer contracts, and equipment leases.

Ensure all licenses and permits are current and transferable. Employee records, benefit plans, and union agreements (if relevant) should be included. Intellectual property, like trademarks or patents, must be documented and registered.

For a comprehensive overview of the required paperwork, you may find How to Prepare Your Business for Sale helpful, as it details the financial and legal organization needed for a successful exit.

Addressing Real Estate and Asset Issues

Real estate and tangible assets also play a significant role when you prepare my business to sell. Collect property deeds or lease agreements if your business owns or rents premises. Make a detailed list of all vehicles and equipment, including titles, warranties, and maintenance records.

Service contracts or maintenance agreements should be organized and up to date. This level of detail assures buyers that key assets are accounted for and in good standing, reducing the likelihood of surprises during due diligence.

Ensuring Data Security and Confidentiality

Confidentiality is paramount as you prepare my business to sell. Organize all documents in a secure Virtual Data Room (VDR), limiting access to only qualified buyers. This not only protects sensitive data but also streamlines the due diligence process.

Sellers who use VDRs report fewer information leaks and a faster path to closing. Modern platforms like Aligned IQ provide free, secure VDR access, offering lower-middle market sellers a confidential, low-risk way to engage with buyers and share documents safely.

Step 3: Enhancing Business Value Before Sale

Maximizing value is critical when you prepare my business to sell. Buyers in the lower-middle market look beyond financials, focusing on operational strength, growth potential, and transferable assets. Strategic improvements now can drive a stronger sale outcome and attract the most qualified buyers.

Improving Financial Performance and Operations

To prepare my business to sell, start by reviewing costs, margins, and pricing strategies. Address outstanding debts and ensure your balance sheet is clean. Document key processes to reduce dependency on any one individual. For owners in the lower-middle market, streamlining inventory management or automating repetitive tasks often unlocks new value.

Buyers pay premium prices for businesses with strong earnings and transparent operations. For a deeper dive into building transferable value, see Unlocking Transferable Business Value.

Strengthening Customer and Supplier Relationships

A diversified customer base helps prepare my business to sell at a higher multiple. Reduce reliance on a few clients and secure long-term contracts where possible. Update your customer list to showcase repeat business, and renew supplier agreements to ensure stability.

Highlight any unique or proprietary relationships in your marketing materials. Demonstrating consistent, recurring revenue reassures buyers and boosts confidence in future growth.

Upgrading Human Capital and Management Structure

When you prepare my business to sell, retaining key employees is essential. Consider incentive plans or employment contracts for top performers. Clarify management roles, document responsibilities, and implement succession plans for leadership continuity.

Buyers value stable, experienced teams. A clear structure reduces transition risk, making your business more attractive to both strategic and financial buyers.

Protecting and Showcasing Intellectual Property

If you prepare my business to sell, ensure all intellectual property is registered and properly documented. This includes trademarks, patents, copyrights, and proprietary processes. Confirm the business owns all IP, not individual employees.

Highlighting unique technology or proprietary products can differentiate your business from competitors. Documented IP adds credibility and justifies higher valuations.

Investing in Technology and Compliance

Modern systems signal that you prepare my business to sell with future growth in mind. Upgrade accounting, CRM, and operational platforms to improve efficiency. Verify compliance with industry regulations and data privacy laws.

A robust tech infrastructure and up-to-date compliance posture attract premium buyers. These investments demonstrate your commitment to best practices and reduce post-sale risk.

Step 4: Building Your Exit Team and Selecting Advisors

Preparing the right team is a critical step when you want to prepare my business to sell. Lower-middle market owners who invest in expert guidance see better results, improved valuations, and less stress throughout the sale process. A strong team supports you from early planning through closing, ensuring you avoid costly mistakes and maximize value.

Assembling a Professional Advisory Team

To effectively prepare my business to sell, start by recruiting a team of seasoned advisors. An experienced M&A advisor or business broker brings deal expertise specific to your industry and size. Add a transaction attorney familiar with lower-middle market deals, a tax advisor to optimize after-tax proceeds, and a wealth planner for your post-sale future.

- M&A advisor: Guides valuation, marketing, and negotiations.

- Transaction attorney: Manages legal risks and documents.

- Tax advisor: Structures the deal for maximum after-tax gain.

- Wealth planner: Plans for your life after the sale.

Each role is essential in helping you prepare my business to sell with confidence.

Defining Roles and Expectations

Set clear expectations for each advisor early on. Define their responsibilities, communication protocols, and success metrics. Make sure all fee structures are transparent and performance-based.

Schedule regular check-ins to track progress and resolve issues quickly. With defined roles, your team can focus on what matters most—helping you prepare my business to sell while minimizing surprises. This approach also ensures everyone is aligned on timing, confidentiality, and goals.

Leveraging Industry Networks and Referrals

Tap into your industry networks to find trusted advisors who understand how to prepare my business to sell in your specific niche. Seek recommendations from peers who have completed similar exits. Attend industry events and conferences to connect with professionals who offer relevant expertise.

Owners who use specialized teams and referrals often achieve higher sale prices and smoother closings. For a deeper dive on how to build the right advisory team, explore this guide on assembling your M&A team.

Take a Tour of Aligned IQ: A Modern Approach to M&A Match-Making

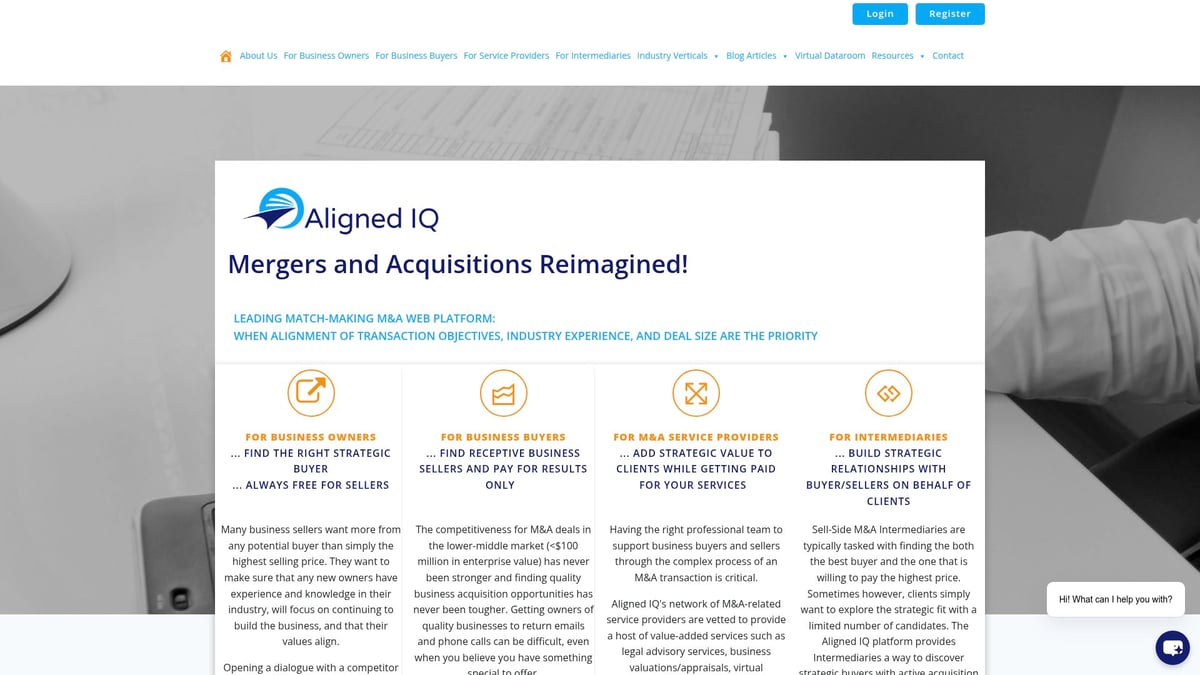

Aligned IQ offers business owners a confidential, secure platform to connect with pre-qualified buyers. The platform emphasizes privacy, giving you full control over which buyers see your information. Unlike traditional broker-led processes, Aligned IQ allows you to build relationships before negotiations begin.

Sellers can use a secure Virtual Data Room for document sharing, streamlining due diligence and reducing risk. Service providers and intermediaries can also join the process, adding valuable expertise. Lower-middle market owners using Aligned IQ benefit from reduced upfront costs and access only to the most relevant, qualified buyers.

Step 5: Marketing Your Business and Qualifying Buyers

Positioning your company attractively in the market is a critical step as you prepare my business to sell. Effective marketing and rigorous buyer qualification can greatly influence the final outcome. This process ensures your business stands out, attracts the right buyers, and maintains strict confidentiality throughout.

Creating a Compelling Confidential Information Memorandum (CIM)

A well-crafted CIM is your primary marketing document. It highlights your business’s strengths, growth prospects, and financial performance. Focus on anonymizing sensitive customer and supplier information to protect confidentiality. Lower-middle market buyers expect clear, concise information that demonstrates value and opportunity.

Include essential elements such as:

- Executive summary and company background

- Financial highlights and adjusted earnings

- Customer and supplier overviews

- Growth opportunities and market analysis

For more detailed steps on preparing your CIM and getting your business market-ready, see Seven Essentials When Preparing to Sell Your Business.

Implementing a Targeted Buyer Outreach Strategy

After your CIM is ready, develop a targeted outreach plan. Identify strategic buyers, private equity groups, and industry investors most likely to value your company’s unique strengths. Leverage your advisory team’s networks and confidential online platforms to connect with qualified buyers.

Consider these outreach steps:

- Prioritize buyers with industry experience and financial strength

- Use industry databases and secure platforms for introductions

- Maintain confidentiality throughout all communications

A tailored outreach approach increases your chances of finding the right fit and achieving your goals.

Qualifying and Vetting Potential Buyers

Screening buyers is essential as you prepare my business to sell. Assess each prospect’s financial capacity, industry expertise, and intent. Require signed NDAs before sharing sensitive details. Evaluate their track record and ensure they align culturally with your business.

Due diligence is critical at this stage. For a deeper look at this process, read the Pre-Sale Due Diligence Process, which covers how to address potential red flags before moving forward with buyers.

Managing Inquiries and Maintaining Confidentiality

Respond promptly to buyer inquiries, but always protect key business information. Track every interaction, document questions, and ensure only qualified buyers access sensitive data. Using a secure Virtual Data Room (VDR) helps maintain confidentiality, reduces risk, and streamlines due diligence.

Strict confidentiality protocols minimize the risk of leaks, which can lead to employee uncertainty or customer concerns. Consistent, professional communication builds buyer trust and keeps the process moving smoothly.

Negotiating Letters of Intent (LOIs)

When you receive offers, compare them based on price, terms, and the likelihood of closing. Multiple LOIs can create a competitive environment, improving your negotiating position as you prepare my business to sell. Negotiate exclusivity periods, clarify deal protections, and review all terms with your advisors.

A clear, methodical approach to LOI negotiation sets the stage for a successful transaction. Take a tour of Aligned IQ for a confidential, secure match-making process that helps connect you with the most qualified buyers in the lower-middle market.

Step 6: Navigating Due Diligence and Closing the Deal

The final stage in your journey to prepare my business to sell is navigating due diligence and closing the deal. This phase is where your preparation, transparency, and organization will be put to the test. The goal is to inspire buyer confidence, facilitate a smooth process, and protect your interests until the very end.

Preparing for Buyer Due Diligence

To prepare my business to sell, anticipate the detailed requests buyers will make for financial, legal, and operational information. Begin by organizing your records in a secure Virtual Data Room, which streamlines access and protects confidentiality.

Compile at least three years of audited financials, tax filings, key contracts, employee agreements, and intellectual property documentation. Address any lingering issues or inconsistencies before sharing documents. For practical steps on how to get your corporate house in order, review Summer cleaning: getting your corporate ‘house’ in order for a potential sale for actionable advice.

Proactive preparation reduces surprises, shortens the diligence timeline, and builds buyer trust.

Managing Buyer Site Visits and Interviews

When you prepare my business to sell, schedule buyer site visits discreetly to minimize disruption. Notify only those employees who need to be involved, and brief your management team on what to expect.

Prepare a clear agenda for each visit. Coach your team to answer questions honestly and highlight operational strengths. Use these meetings to reinforce the value of your business, share growth stories, and address any buyer concerns with transparency.

Thoughtful planning for site visits helps maintain confidentiality and demonstrates professionalism.

Finalizing Deal Terms and Legal Agreements

At this stage, your advisory team becomes invaluable. Work closely with your M&A advisor, attorney, and tax expert to negotiate the purchase agreement. Focus on deal structure, payment terms, non-compete clauses, and any transition support you have agreed to provide.

Review all legal documents thoroughly. Ensure that representations and warranties are accurate and that your interests are protected. This is especially important in the lower-middle market, where deal terms can vary widely.

A collaborative approach with your advisors will help secure favorable terms and set the stage for a smooth closing.

Coordinating Closing Logistics and Transition Planning

Next, coordinate all closing logistics. Confirm that every required document, consent, and regulatory approval is in place. Plan the transfer of assets, contracts, and licenses in detail.

Develop a communication strategy for employees, customers, and suppliers. Clear, timely messaging prevents confusion and preserves business stability as ownership changes hands.

Meticulous planning at this step ensures nothing is overlooked and helps prevent last-minute delays.

Post-Sale Considerations

After closing, fulfill any transition support or training you promised. Work with your advisors to manage final tax filings and post-closing financial matters.

Reflect on your goals when you first set out to prepare my business to sell. Owners who plan for post-sale obligations avoid disputes and leave a positive legacy for both employees and buyers.

For a modern, confidential approach to meeting qualified buyers and streamlining due diligence, Take a Tour of Aligned IQ: A Modern Approach to M&A Match-Making.

You’ve just explored a detailed roadmap to prepare your business for a successful sale in 2026, from clarifying your goals to building your advisory team and ensuring a smooth closing. If you’re ready to put these strategies into action and want a confidential, efficient way to connect with the right buyers, I invite you to see how Aligned IQ can support your journey. Their secure, private platform is designed to make the M and A process more collaborative, putting your interests first at every step. Curious to see how it works in real life Take a Tour!

No responses yet